AI in Auto Insurance Market Size and Growth Projections to 2027 - Reach $5.5 Billion at 20.5% CAGR Led by H2O.ai, Traffk

The global AI in Auto Insurance market to grow at a CAGR 20.5% to reach US$ 5.5 Billion by 2027 from US$ 1.0 Billion in 2018 during forecast period (2019-2027)

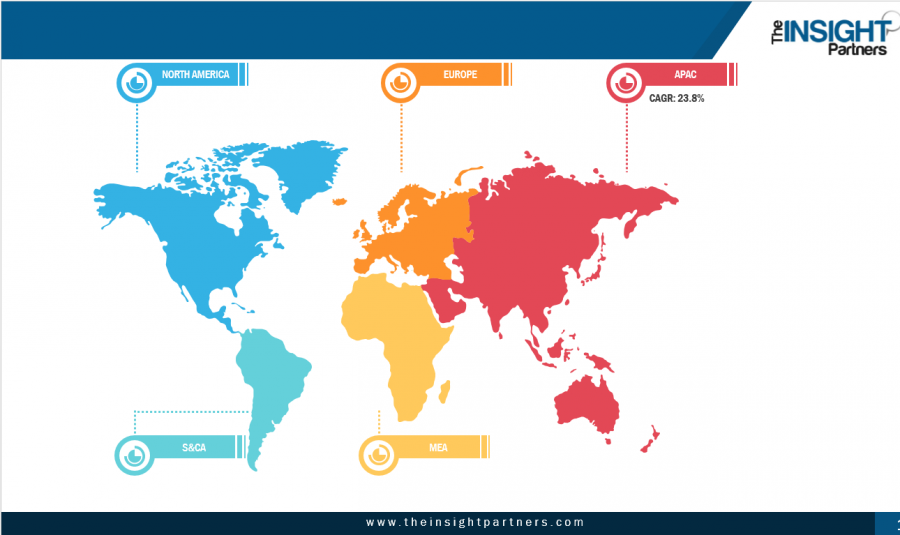

PUNE, MAHARASHTRA, INDIA, December 10, 2019 /EINPresswire.com/ -- The AI in Auto Insurance Market research study focuses on the current market Size, Revenue, Share, status, future forecast, growth opportunities, key market players. The study objectives are to present the AI in Auto Insurance development in North Americas, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America (SA).

Artificial intelligence is transforming the face of every industry worldwide owing to its revolutionary capabilities that could substantially affect the performance of a business. In the past few years, banking, financial services, and insurance (BFSI) sector has been one of the largest adopter of artificial intelligence technology. In the current scenario, automotive is also opting for AI. On the other hand, higher disposable income among the individuals, the pattern of procurement of new vehicles is high in the country. Pertaining to the rise in the number of vehicles, several associated technologies and solutions are also increasing rapidly. These factors have positively impacted on the growth of the AI in auto insurance market in the region.

In 2018, Europe was estimated to hold the largest market share Whereas, Asia Pacific expected to be fastest region with a CAGR of 22.7%.

In Europe, Germany led the AI in auto insurance market. Germany is one of the leading producers of automobiles in the world and many major car manufacturing companies are located in the country including Volkswagen, BMW AG, Audi, and others. The market for is growing in Germany but the solution remains very niche. Insurance providers are uncertain of what business strategies work best and customers are still unaware with the products. Also, privacy concerns make consumers cautious of sharing data in Germany. Major IT hubs housed in the European continents, huge automotive industry in Germany spread across the European continent have contributed towards the growth of the market in this region.

The major players operating in the market for AI in auto insurance market are ANT Financial Services Group, CCC Information Services Inc., Claim Genius, Clearcover, Inc., GEICO Corporation, ICICI Lombard, Microsoft Corporation, Nauto, Progressive Casualty Insurance Company, and Solaria Labs among others.

Get Sample Copy of this report at https://www.theinsightpartners.com/sample/TIPRE00006900/

The global auto industry is going through a shift with technological advancements happening in the electric vehicle and autonomous vehicle sector. There are few technology trends where AI can help insurance companies and brokers make profits by integrating technology in their present product and service portfolio. Some of these major trends include behavioral policy pricing, personalization of customer experience & coverage, and customized claim settlement.

With increasing number of IoT (internet of Things) enabled devices with various among customers, the opportunity to offer personalized services is growing at a fast pace. Customized coverage or on-demand insurance is another benefit through which customers get custom coverage for some specific events/items. With the help of virtual claim adjusters and online interfaces, artificial intelligence help customers in settling the claims faster and efficiently. Thus, upcoming applications of artificial intelligence in the auto insurance industry, the AI in auto insurance market is anticipated see tremendous growth during the forecast period of 2019 to 2027.

The AI in auto insurance market has been derived from market trends and revenue generation factors from five different regions across the globe namely; North America, Europe, Asia Pacific, MEA, and SAM. In the current automotive insurance industry, AI in auto insurance is at a nascent stage, as very few countries have adopted the technology heavily.

Directly Purchase OR Place an Order a copy of this Research Study at https://www.theinsightpartners.com/buy/TIPRE00006900/

Geographically, the market is dominated by Europe. The region’s growth is rapidly driven by robust automotive industry and demand for wireless & connectivity technologies. The dominance of Europe in the global market is due to the fact that, the country houses a large number of automotive OEMs, telematics companies, and insurance companies. Additionally, the trend of adoption of newer technologies and solutions is also high in the country, which has pushed the residents to opt for AI in auto insurance. The Asia Pacific is estimated to be the fastest growing region in the global AI in auto insurance market during the forecast period from 2019 – 2027. This is majorly due to the significant adoption of the same in countries such as China, Singapore, India, Malaysia, and Japan among others. The number of vehicles in the countries are constantly increasing, and the adoption of auto insurance is also rising in the current scenario.

Key findings of the study:

Asia Pacific is the fastest-growing region in the AI in auto insurance market. The AI in auto insurance market in APAC is booming, although it has still not achieved the penetration as in Europe and North America. Ant Financial — a part of Alibaba group, is a fintech company in China that employs over 3,000 people. The company has recently Ding Sun Bao — a software that it claims analyzes the damage in vehicle and handles the claims with the help of machine vision. Aforesaid factors supports the high growth of AI in auto insurance in the Asia Pacific region.

The global AI in auto insurance market is anticipated to witness impressive growth during the forecast period, owing to high adoption of AI in most of the industries, AI has significantly found its way in the automotive sector. AI enables car insurance companies to efficiently offer services to its customers that are looking for faster payouts, faster services, and customized policy prices. The AI in auto insurance market enables the insurance companies to reach out to its customers at the right time, offers the right set of products, and faster the claim process. Usage based insurance by offering in 2018 led the AI in auto insurance market and is expected to be the fastest-growing offering during the forecast period 2019-2027 growing at a high CAGR value.

Sameer Joshi

The Insight Partners

+1 646-491-9876

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.